The program is in lieu with the Visa Ready Program, Visa’s eponymous digital transactions platform. This was previously used only by mobile point-of-sale acceptance (mPOS) providers, mobile NFC-enabled device manufacturers and chip and platform providers. However, now it will provide companies one seamless path to integrate secure payments into their products and services.

A mentorship program for Internet-powered point-of-sale

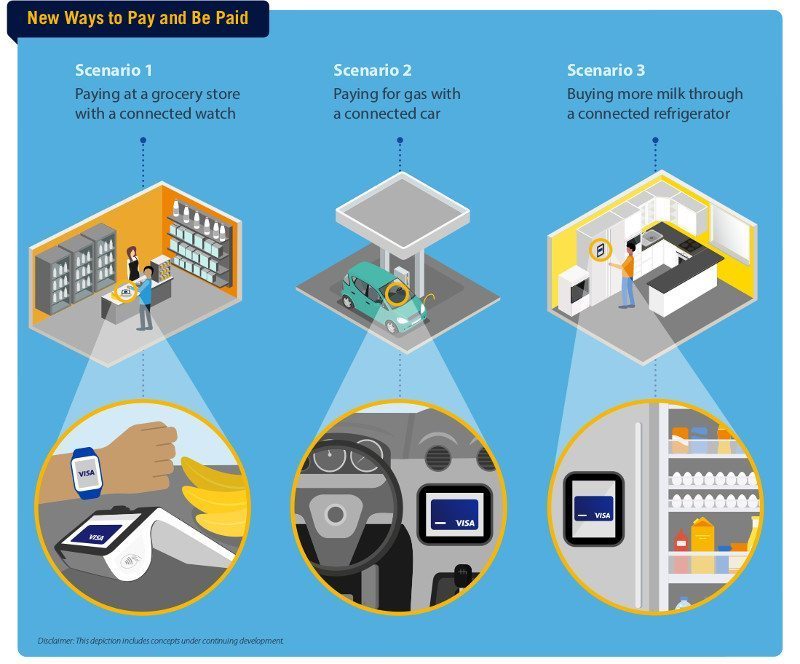

The Visa Ready Program for Internet of Things would provide IoT device manufacturers with a path to embed secure payments into their connected devices, enabling anything from a watch to a car to initiate payments. Imagine with just a touch of a button, consumers could pay for gas, grocery or parking without leaving their connected car. New Visa Ready strategic partners can work with device manufacturers to create these types of payment experiences and guide them through the Visa Ready certification process.

Visa is known to offer its partners valuable guidance on managing secure transactions at par with the market’s best practices. In addition, it supplies members with tools such as Visa’s Digital Enablement Program (VDEP) and Visa’s Token Service (VTS), a token technology that, like Apple Pay, Android Pay, and MasterCard’s MDES, substitutes the personal information found on credit cards with a unique identifier. This innovative security technology allows secure mobile and digital payments anywhere there is an Internet connection.

“More and more, consumers are relying on smart appliances and connected devices to make their lives easier,” said Jim McCarthy, executive vice president of innovation and strategic partnerships at Visa, in a statement. “By adding payments to these devices, we are turning virtually any Internet connection into a commerce experience.”

Digital payment solutions from Visa

The first IoT companies to join the Visa Ready Program will focus on payments for wearables and automobiles. The company has already partnered with Honda and ParkWhiz to turn your car into a wheeled smartphone or credit card.

Together with Honda, Visa is developing an app that will track the fuel requirement intimating you about the

necessity to refuel as well as about the nearest gas station. The app will further provide information about the exact amount of fuel needed to fill the tank and the corresponding cost to fill up. But this doesn’t end here! You also get a chance to purchase convenience store items with full integration of discount and loyalty/rewards programs. The app will be easily accessed via the car’s dashboard.

“This project demonstrates how apps can truly transform the in-car experience while creating new opportunities for automakers,” said John Moon, developer relations lead for Honda Developer Studio.

The collaborative work of Visa and ParkWhiz brought out a parking app like never before. This enables you to pay the exact price for a parking spot without under or overpaying. Once a parking session ceases, the elapsed time and amount paid would be displayed on your car’s dashboard, with the transaction just a button press away.

Mobile technology is escalating the pace of payments industry, opening new doors to a generation of consumers who increasingly rely on connected devices to manage their money, purchases, and much more. The number of IoT enabled devices is expected to reach 50 billion by 2020 according to Cisco, scaling up the scope for secure payments to be a feature in just about any form factor. This is an opportunity that Visa couldn’t leave to tender mercies. No wonder Samsung is one of the first companies to bag its first call on the Visa Ready Program, alongside Accenture, universal payment card company Coin and Fit Pay!