What is PCM?

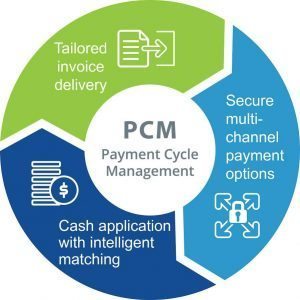

Payment Cycle Management is an automated invoice-to-cash (a process from the time invoice is created till the customer’s debt is settled) solution that takes care of various electronic billing requirements. The solution eliminates the burden of invoice and payment cycles by channelizing processes, saving time and resources.

PCM is the process of getting invoices to customers using a variety of methods mentioned above. It can accept payments in any number of form and apply cash into the business. According to the company an automated PCM solution will digitize this process, speed it up, and remove the likelihood of human error.

Quantum PCM claims to channelize three key areas of the invoice-to-cash process:

- Quantum Invoice: an integrated invoicing solution that automates and accelerates invoice delivery for customer. It enables the Accounts Receivable team to automatically deliver invoices to customers in any format and through any channel they prefer.

- Quantum Payments: helps customers to make payments in a hassle-free way with a wide range of electronic channels in order to perform quick transaction and maximize customer satisfaction. The electronic channels consists of web portal, invoice central and email solutions.

- Quantum Cash Application: Billtrust claims that this solution tracks every customer’s remittance (to send money or make payments) statements, and then applies payments automatically. Quantum Cash App also claims to improve its predictive performance over time as exceptions are handled and noted by the system.

Flint Lane, CEO and Founder of Billtrust said, “We are singularly focused on automating every part of the AR process. And we are the only end-to-end invoice-to-cash solution available today.”

Quantum Payment Cycle Management is comprised of Quantum Invoicing, Quantum Payments, and Quantum Cash Application. Together, they streamline and accelerate what has traditionally been manual and labor intensive processes, allowing our clients to use one vendor for all of their invoice-to-cash needs.

The New Jersey based company believes, with this solution, clients can take advantage of its eAdoption program that was launched in the year 2014 in order to elevate electronic invoicing and payment adoption which results in increased customer satisfaction and reduced in days sales outstanding (DSO).DSO is a financial ratio that shows how a company is managing its accounts receivables.

Working closely with clients, Billtrust’s eAdoption team develops and executes comprehensive marketing campaigns to their customer base, increasing usage of electronic invoicing and payments up to 70 percent more than when clients implement electronic adoption programs on their own. This translates directly into increased cash flow and operational efficiency.