Sean Zinsmeister, VP, Product Marketing, Infer in an exclusive interview with Techseen discusses the growth of modern sales and marketing technology and how AI is all set to make a mark in 2017 too.

Techseen: While some predict mass unemployment or all-out war between humans and artificial intelligence, others foresee a less bleak future. What’s your take?

Zinsmeister: I think Google CEO Sundar Pichai had the best analogy, that AI is the new mobile. Given the saturation of smartphones and mobile apps, it would be insane not to include mobile in your digital strategy, whether for product development or go-to-market. Companies need to start thinking the same way about AI, and little by little add predictive and prescriptive analytics into workflows to increase the quality and productivity of everyday work.

With any new technological innovation, there is always some vocational disruption, but the upside is that AI has the ability to remove redundant tasks, increase productivity, and improve overall quality of work. It’s less about the removal of jobs and rather the evolution of jobs.

For example, sales and marketing professionals are overwhelmed with the amount of data they are faced with everyday. Sales reps need to know who to sell to, and marketers need to know who to market to, but there’s no way to employ enough humans to accurately answer these questions. AI helps companies automatically sift through troves of data to make sure they are picking winners and spending time in the right places.

Techseen: One of the escalated trends in technology observed in the last few years is automation. And now we are seeing the technology get more intelligent with built-in tools. Where do you see this process heading in the next five years?

Zinsmeister: In the next 5 years, we are going to see a reimagining of automation through AI and the power of data science. These new levels of intelligence will finally deliver on the promise that technologies like Marketing Automation fell short on. Automation systems built 5-10 years ago simply were never meant to handle the amount of data that today’s platforms require in order to produce actionable intelligence. In addition, I imagine the enterprise will experience innovation similar to the voice-activated AI we’re seeing in soon-to-be mainstream consumer products like the Amazon Echo. This new era of automation will bring more intuitive, user-friendly capabilities to enterprise software.

The real question that businesses need to be asking themselves is NOT “What is our AI strategy?” but rather, “Where can we employ automation and intelligence together to increase the productivity and happiness of our employees, while improving our overall customer experience?”

Automation is not going to be about as Seth Godin so aptly puts it, “Selling more average goods to average people.” It will be all about gaining a deeper understanding of our customers, creating more personalized experiences and building better products.

Techseen: What according to you are the major marketing hurdles in digital media and what methods do you suggest to overcome them?

Zinsmeister: Now that more people are thinking about AI, there’s a new burst of noise on the market that’s causing market confusion. Business buyers need to understand which products are overpromising and under-delivering, vs. the ones that have shown proven success through tangible results and customer stories. The key to breaking through the noise is elevating the voice of the customer through marketing strategies that create a platform for our customers.

For example, last year we launched the Stack & Flow Podcast as Infer’s own media channel to promote the good work of our customers, partners and friends in the industry. The show has really taken off, and after just a few months we’ve garnered over 47 5-star reviews on iTunes and over 2,000+ listens on SoundCloud. We’re very encouraged by the early results and excited to grow this channel further – especially as topics such as AI and automation continue to gain mainstream traction.

Techseen: As per my understanding, in simple terms, predictive analytics look at historical data to predict the future. Does that mean they are incapable of finding new opportunities as the world changes beyond your CRM?

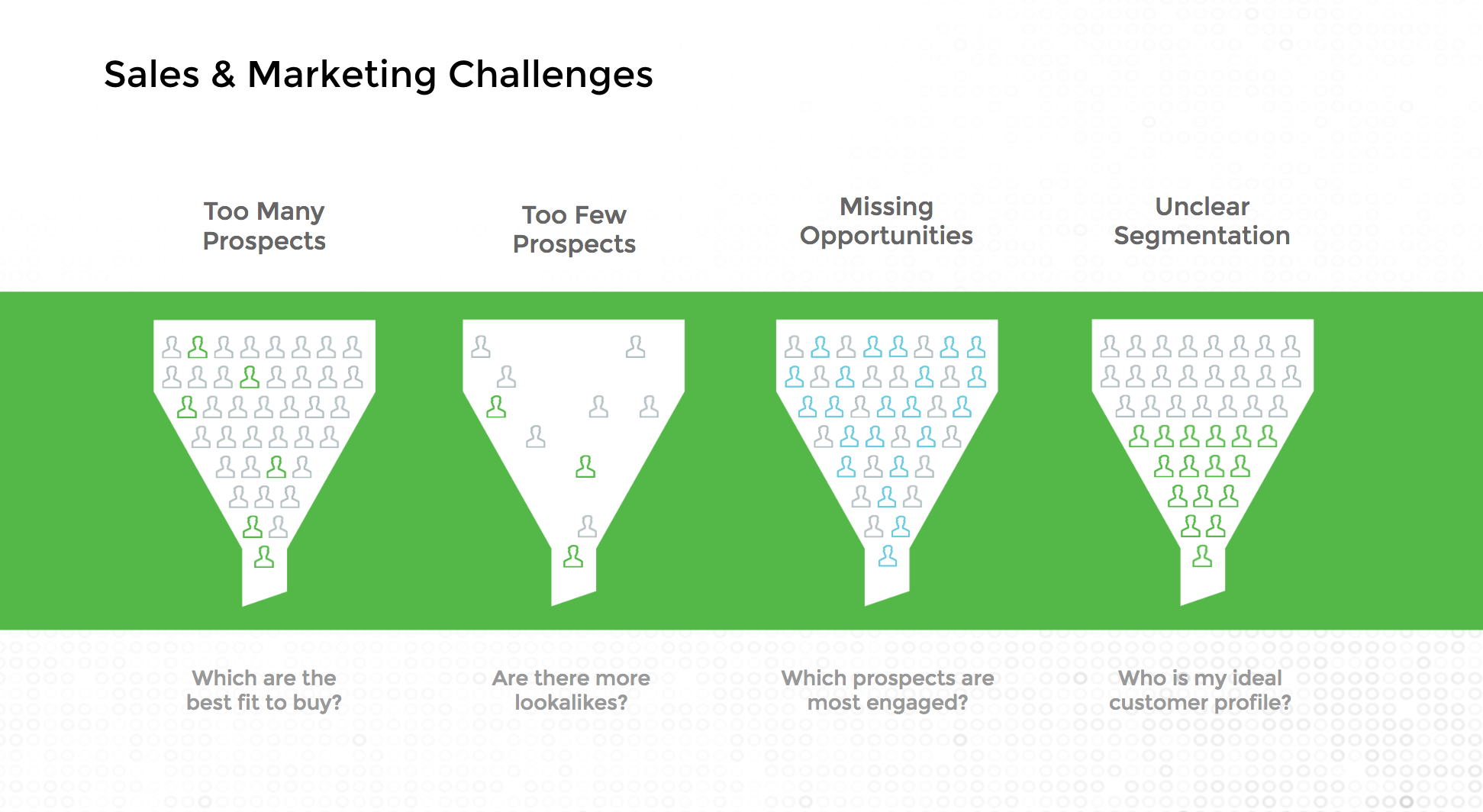

Zinsmeister: Not at all. There are actually several different types of predictive analytics models businesses can employ. Our customers are typically trying to solve at least one of these basic challenges:

1. I have too many leads, how can I find the best ones?

2. I have too few leads, how can I find more that look like my ideal customers?

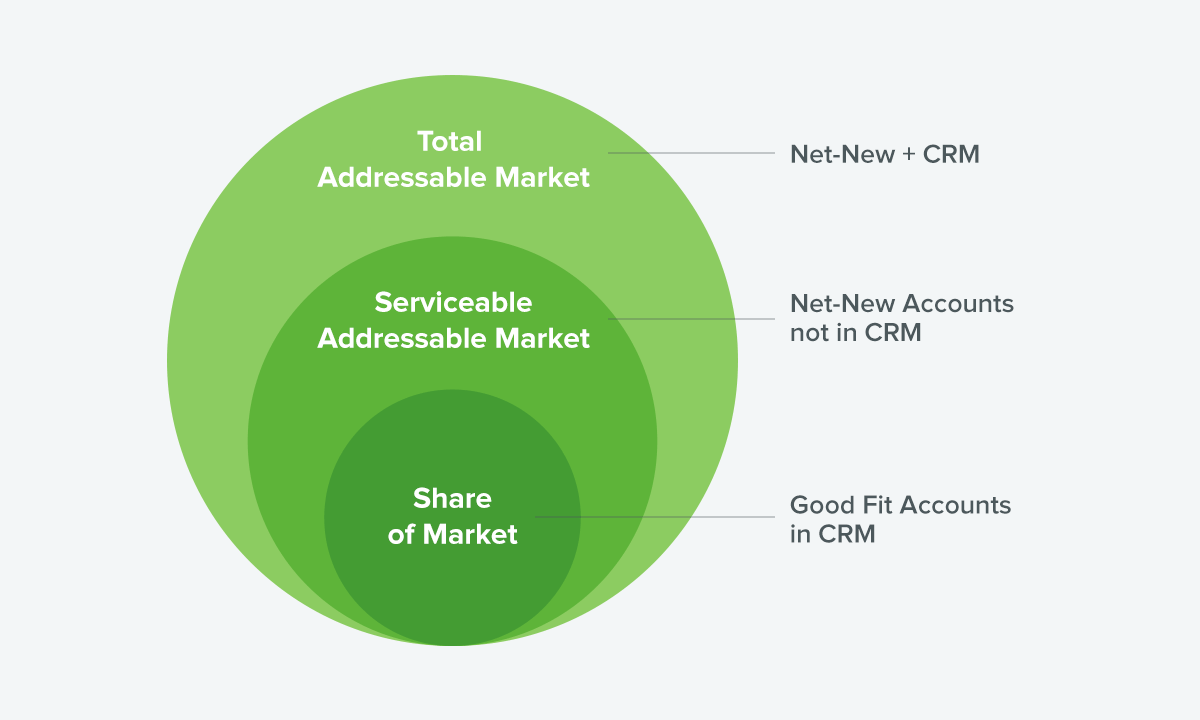

The first is an inbound problem that’s common as businesses grow. They start to build up inbound inquiries and need the help of predictive models to prioritize a huge pile of leads that their SDRs couldn’t possibly sift through effectively. However in many cases, inbound alone is not enough for business growth. We’ve seen more businesses looking to account-based strategies in order to go after B2B customers that are a good fit for their product and also bring higher than average ACVs (average contract values). In these outbound cases, companies need help not only with prioritizing the best accounts from their CRM, but also with discovering new ones to go after.

These “net-new” models use predictive to triangulate multiple third-party databases that source leads. They find the accounts and contacts that look more like your best customers and add them to your system. Both predictive approaches are necessary in order to complete an accurate TAM (total addressable market) analysis and build a sound go-to-market strategy.

Techseen: While handling sales and marketing, you gain access to user information that is fed while operating the mobile apps. What solutions do you employ to assure that sensitive user data be handled securely?

Zinsmeister: Security is a top priority for our business, and we access and interact with user data just like most established enterprise systems, i.e. Marketing Automation. Infer goes even further to protect sensitive information by adding end-to-end encryption, isolating customers’ data on secure servers, and employing annual penetration testing.

Techseen: In 2016, we saw explosive growth in ABM (Account-based marketing) acceleration and adoption. Why do you think B2B companies are focused on driving ABM programs? How will the trend be in 2017?

Zinsmeister: I think that in 2017, we will actually see a fair bit of ABM normalization. In other words, ABM will simply be a standard part of the marketing mix, as opposed to an overhyped strategic concept. It’s a fool’s errand for businesses to choose between inbound vs. outbound — they should all be doing both. In fact, I’ve noticed many dangers in companies that focus too much on ABM. They might capture the “whale account” they were chasing, but to the detriment of the rest of the business opportunities that they ignored in the process.

ABM became hot as businesses started to realize they were not able to achieve their growth goals with inbound alone. They couldn’t afford to just sit back and wait for the leads to come to them. And as a result of employing more outbound strategies, they actually ended up creating more inbound interest as well.

The other reason ABM is top of mind is all about expanding the revenue portfolio. If you are not able to generate a higher volume of leads at the top of the funnel, you have to look upmarket towards higher ACVs in order to to grow your business.

Techseen: In August this year, Infer introduced a behavior scoring offering to help companies accelerate revenue generation by supercharging their ABM programs. How do you help companies understand which of their top accounts are in the market at any given time? What data mining techniques do you employ for the same?

Zinsmeister: Our account-based behavior scoring was a great complement to the Infer account-based fit scoring that companies were already using for account selection. In many cases, businesses running ABM strategies have a limited ecosystem of accounts, so after the initial value they gain through prioritization and predictive models for net-new leads, there is a gap when it comes to identifying which accounts are most engaged and in-market to buy. In order to fill this gap, our new offering cracks open the full spectrum of activity data from Marketing Automation systems, and mines it to best understand which accounts are likely to make a purchase soon.

This now adds a second dimension to ABM strategies: timing. In addition to knowing an account is a good fit, you can personalize engagement strategies based on the activities of a particular account. With a better understanding of the content they are consuming, and the buying signals they are emitting, your company gets a full view of the customer’s buying center. As new leads contacts enter the buying committee, Infer will match them to the appropriate accounts, and your team can engage accordingly.

Techseen: Personal assistants like Alexa and Google Assistant have a widespread popularity now. Do you think we will soon reach a point where we can get answers to questions like “Which cars can I buy in a specific budget?” Or “Which is the best insurance policy in the market?” Without having to compare data ourselves?

Zinsmeister: I think we’re very close. There’s simply too much data out there, and people are yearning for intelligent curation to help them narrow down all of their choices and variables. To use your example of car buying, this is why services like TrueCar have become very popular. I believe many buying suggestions will be intelligently sourced from your personal network, i.e. choosing insurance providers based on experiences of people you trust.

As AI listens more and gathers data, I imagine many devices will eventually know your patterns better than you perhaps know yourself. Ever had a hard time deciding where to eat out? You’ll be able to ask Alexa or Siri, and it will uncover new restaurant choices to try based on your past visits and reviews.

The main question here is going to be how much consumers will trust the recommendations they get from AI. They key here will be how the data itself is gathered, and how diligent users are as feedback mechanisms. For example, if a person is not willing to train the AI to know that they happen to be lactose intolerant, the systems won’t be able make great food recommendations. But as consumers get comfortable sharing more data, the recommendation engines and suggestions will become more and more personalized to their tastes.

Techseen: How do you look at the APAC market in its preparedness for security breaches as compared to the West?

Zinsmeister: I don’t see the APAC market any differently than other regions when it comes to cyber security. This is something that all business need to be prepared for in the current climate, and many of the customers we work with have offices all over the world. They’ve each taken IT precautions to ensure all global entities are protected.

Techseen: Can you comment on Infer’s engagement with start-ups, SMBs and non-traditional innovators in the space?

Zinsmeister: Infer is constantly engaging with both young startups and mature businesses of all types. It’s in our best interest to do so, because we can spread our learnings across the whole community of predictive innovators and successfully build models that help accelerate their growth.

The Infer executive team is very active in the startup community, and we’re always looking for ways to share our expertise with SMBs like this through articles, seminar engagements, informal coaching, etc. Given how early it still is in the age of AI and predictive, Infer is of course continuously exploring new opportunities beyond B2B midmarket as well, such as enterprise companies.

Techseen: What is your current team strength and do you plan to expand into other regions like APAC or EMEA anytime soon?

Zinsmeister: Many of Infer’s current customers already have offices in EMEA and APAC — such as NewVoiceMedia, Hubspot, Zendesk, AdRoll, Nitro, Brightcove and many others. In many instances, we’ve built predictive models specifically for EMEA teams. The global footprint we have from these existing companies has already garnered early awareness for Infer in many parts of the world. In fact, we are seeing more inbound interest coming from UK companies and throughout EMEA, and expect this region to be an area of exploration for our go-to-market initiatives and a growth opportunity in the coming years.