The survey was based on responses from 1,700 services-focused self-employed professionals and small business owners in the US, and examined several categories that have a direct impact on running a small business.

According to the survey, 7 out of 10 self-employed individuals have no intention of returning to traditional employment and intend to grow their business.

“In the next five years, self-employed professionals will make up nearly half of the U.S. workforce, yet everything from health care to America’s tax code cater to larger businesses,” said Mike McDerment, CEO, FreshBooks.

How difficult is finding new clients?

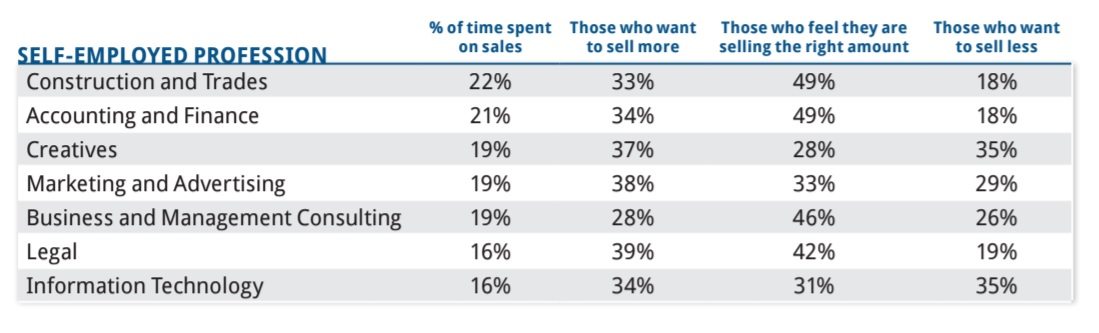

The survey further revealed that self-employed professionals spend relatively little time seeking new clients. Roughly 40% say they put one-tenth or less of their time into sales and prospecting while 75% are investing less than one quarter of their time in these areas.

So what’s the optimal level of investment in business development for a small business? Just under half say they’re doing the right amount of selling. The study observed considerable variation across industries. For example, just over 1 in 4 creative professionals, have found the right balance in selling versus practicing their crafts, compared with half of those in construction and trades.

Expectations from Government

Independent professionals aren’t necessarily clamoring for governments to step in and offer them more safeguards and/or supports. 40% want somewhat higher taxes and get similar public supports that employees have, and 60% want minimal taxes with minimal support from public programs for their business or self-employment.

According to the survey, entrepreneurs are clearly looking for government to focus on health care with more than half ranking it first or second among a list of proposed small business policies.

Seeking financial support

Most independent professionals and small business owners are able to self-finance their operations. Just 1 in 5 independent professionals required any financial capital to get started. The most common source of start-up capital is a small business owner’s personal savings. A third of those requiring start-up cash lean on credit cards.

Most independent professionals and small business owners are able to self-finance their operations. Just 1 in 5 independent professionals required any financial capital to get started. The most common source of start-up capital is a small business owner’s personal savings. A third of those requiring start-up cash lean on credit cards.

But a majority believe that big banks aren’t designed to service their needs and wish there were more alternatives. As a result, almost 1 in 2 do not have a business relationship with a bank.

25% have been rejected as borrowers because of their occupational status.

Jacks of Many Trades, Masters of Some?

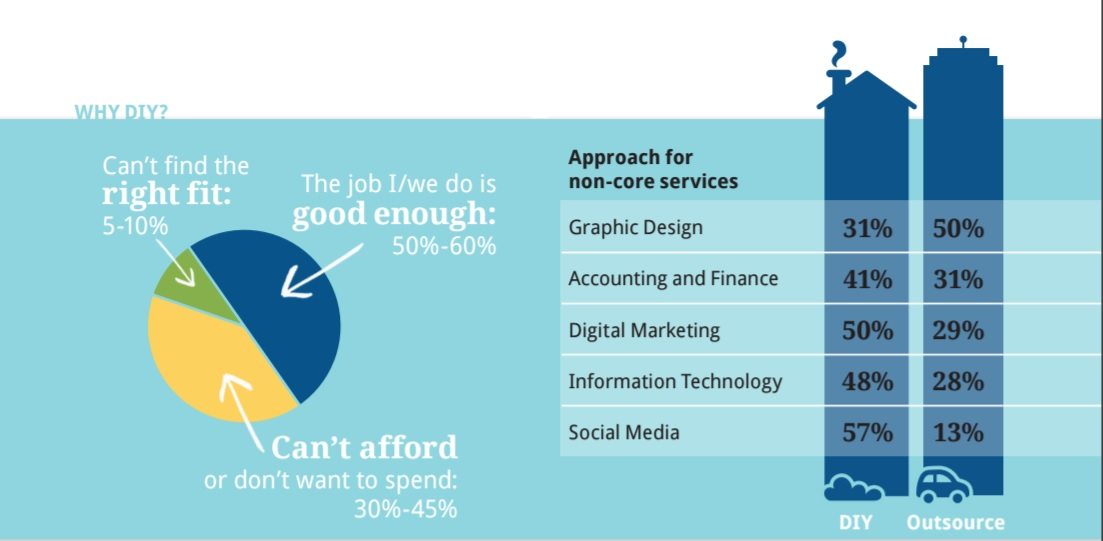

Few self-employed professionals outsource for a variety of business support services, despite a lack of in-house expertise. 30%-60% are taking a Do-It-Yourself (DIY) approach for services which they have no internal expertise, such as digital marketing, information technology, or social media. Independent professionals hire other independent professionals to boost independent work economy. 66% of those surveyed simply prefer working with other small businesses.

Entrepreneurs at risk of selling themselves short

Many self-employed and small business owners are unsure how much to charge for their services. Almost half find it a challenge to justify the rates or prices they would like to charge. This uncertainty manifests in very real ways for independent professionals and small business owners.

As with selling and prospecting, self-employed professionals rely on their network for input. A significant number have tried raising rates to see what happens. A small – though likely growing – number have discovered online tools or apps that help them approach pricing with additional rigor.

Independent professionals underutilize some of the most effective prospecting approaches.

Digital one-to-many sales and marketing practices (e.g., content and/or email marketing, blogs) are effective for small businesses but generally underutilized.