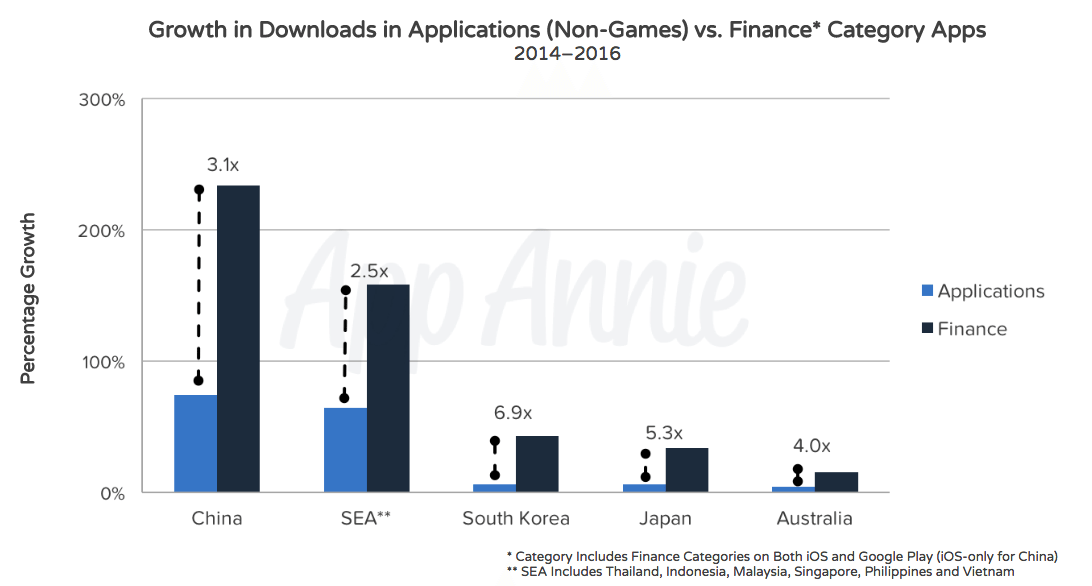

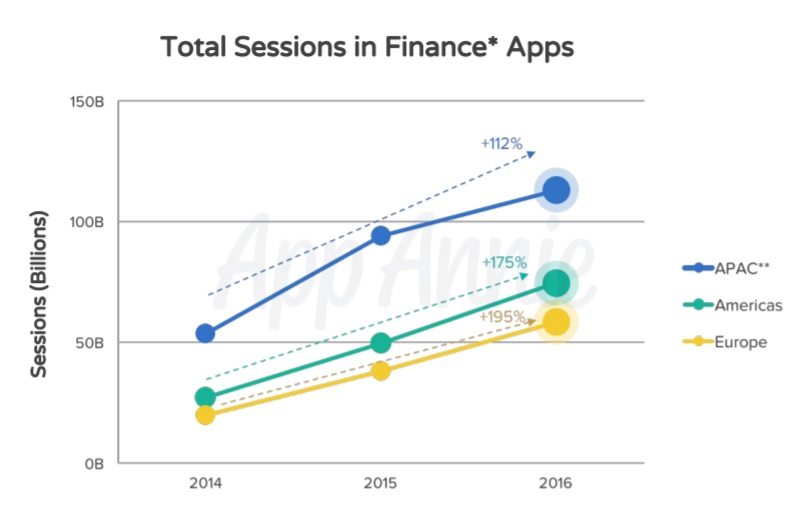

According to the report, finance category downloads grew faster between 2014-2016 than all other app categories excluding games combined worldwide. Globally, total sessions in finance apps have increased more than 100% over the past two years. While the Americas and Europe grew rapidly, APAC’s growth was the strongest. Furthermore, in Asia-Pacific, more than 110 billion sessions took place in finance apps in 2016.

“More and more people are turning to mobile apps for their banking and finance needs and apps have now become central to these companies’ customer initiatives,” said Danielle Levitas, SVP of Research, App Annie.

“Apps provide a convenient, secure and personalized service for the ever-connected consumer to execute financial transactions. They provide banks and other financial institutions with a unique opportunity to enrich relationships with customers, reduce costs associated with in-branch transactions, and create new growth opportunities,” Levitas added.

Report Highlights include:

Asia-Pacific sees a hike in Finance apps usage

- Download growth in finance apps exceeded download growth for all app categories excluding games across major Asia-Pacific markets. China experienced a 230% spike in downloads in 2016 to 6.7 billion, and more than tripled the growth rate of the sum of downloads across all apps excluding games.

- Total sessions in finance apps more than doubled in 2016 compared to 2014 in Australia and South Korea.

- Users in South Korea had over 7 billion sessions in banking apps in 2016. This was nearly 4x as many compared to Australians. Meanwhile, mobile banking apps in Japan have seen lower engagement levels due to the country’s entrenched cash-based culture.

- In Australia, banking apps have become the gold standard for routine banking transactions. The number of average monthly sessions in the top 10 Australian banking apps exceeds more than 25 times per month, indicating mobile banking apps are part of Australians’ daily routine.

Fintech apps can have lasting impact on conventional banking businesses

- Trading and investment apps dominate China’s top fintech offerings.

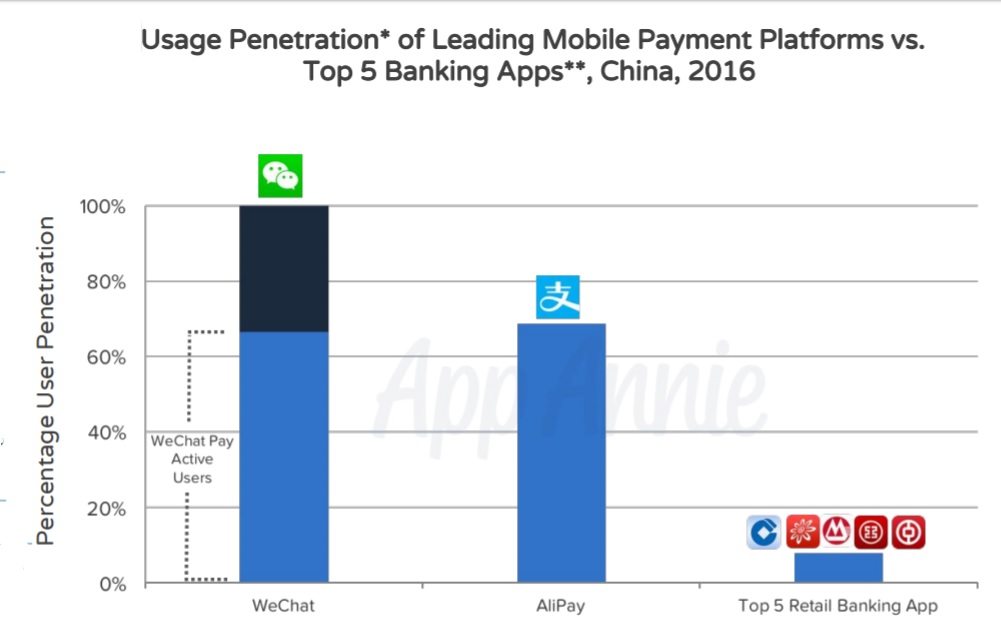

- WeChat Pay and AliPay are the leading mobile payment platforms in China with usage penetration that is approximately 7x greater than the average of the top five banking apps in China.

The report hence indicates that the success of both WeChat Pay and AliPay provides insight into how non-banking technology players can challenge the finance and retail banking sectors.

The report hence indicates that the success of both WeChat Pay and AliPay provides insight into how non-banking technology players can challenge the finance and retail banking sectors.