What are cloud-native apps?

Cloud-native applications are composed of microservices that are independent of each other. The applications are usually built and run using Platform-as-a-Service (PaaS) and are in contrast with traditional monolithic applications, which are deployed as single entities (might run on-premises or migrated to the cloud). Continuous delivery, microservices, containers, and DevOps are core features of cloud-native architecture.

“This is an exciting shift in our industry. We predict that cloud-native architectures will become the default option for customer-facing applications by 2020, driven by a need to continuously deploy innovations at an accelerated pace and enhance the customer experience. Businesses that delay adopting this approach will struggle to make up the gap with cloud-native competitors,” said Franck Greverie, Cloud and Cybersecurity Group Leader, Capgemini.

“Organizations need to listen to their CIOs and understand the huge potential of cloud-native technology to deliver business benefits and innovation. CIOs must also address culture and skills gaps within their own organizations on the road to being cloud-native leaders.”

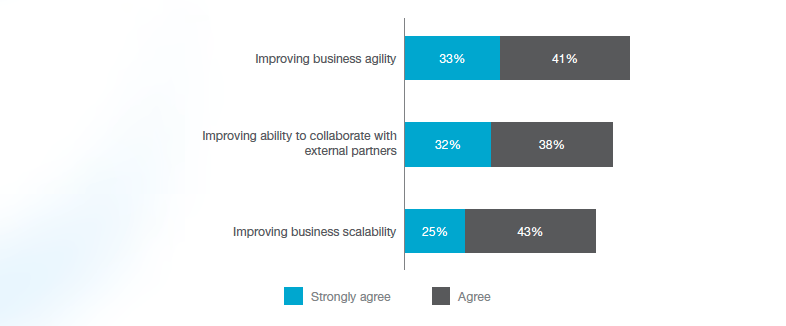

According to the survey 74% respondents stated that this shift in cloud adoption is for a desire to improve business agility, whereas 70% wanted increased collaboration with external partners and 67% wanted to deliver better customer experiences.

The report identifies a small group of organizations, those that have more than 20% of their new enterprise applications developed as cloud-native, that are likely to report increases in organizational revenues because of cloud-native applications than slower adopters.

In comparison with organizations which have adopted cloud-native applications to those who have 10% or less of their new enterprise apps on cloud-native, 69% are more likely to describe their approach to software development as agile to 39% which are lagging behind.

78% of these companies also describe their deployment as automated in comparison to 46%, which don’t. And 69% of these organizations describe their DevOps teams as integrated compared to 38%, which are lagging.

CIO’s expectations

According to the report these companies also display a more growth-focused attitude towards IT functions, 90% with improving the customer experience, 87% with business agility and scalability, as well as 79% viewed this adoption as higher priorities than reducing costs.

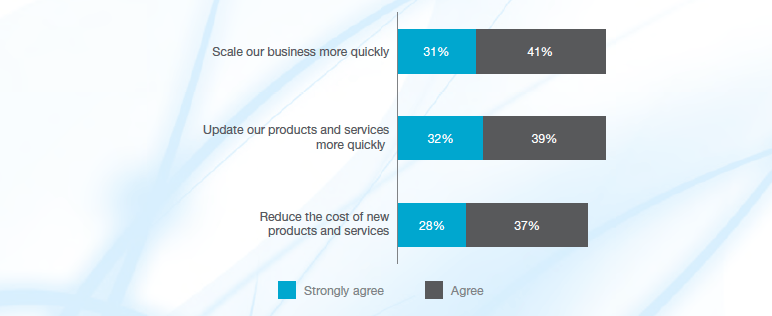

As adoption increases, CIOs at organizations leveraging or planning to leverage cloud-native applications expect IT to become even more central to supporting business ambitions. 67% of CIOs expect the development of new business models, 72% expect rapid scaling of the business, 71% expect quicker updating of products or services, and 68% expect adopting new routes to market.

Challenges

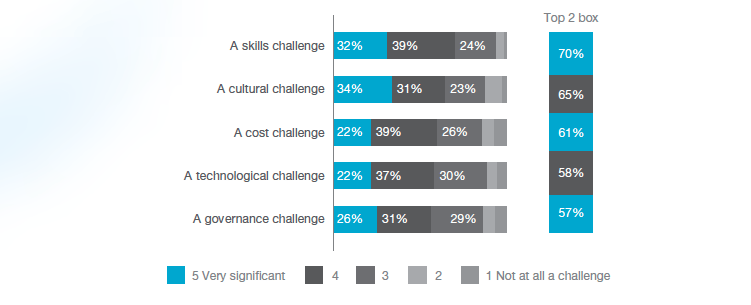

Many CIOs are facing challenges in building business cases to invest in cloud-native apps from business leaders that see cost reduction as the priority for IT teams. These challenges range from the organizational where 65% believe that they have to battle an ingrained culture that is opposed to the nature of cloud-native working and 70% think that there is a shortage in skills when it comes to developing cloud-native apps.

When it comes to the technical side, 62% believe that they will face difficulties in integrating with legacy infrastructure and 58% think they are being locked into vendor contracts.

Sectorial adoption

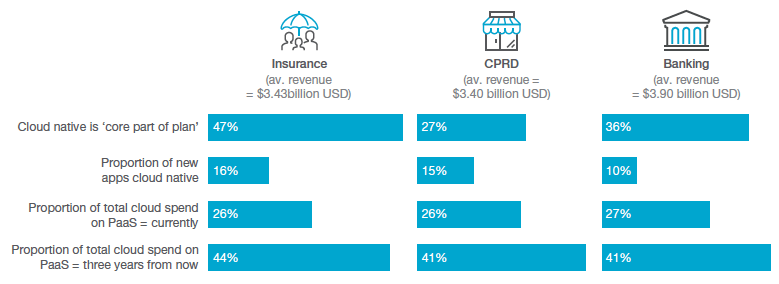

According to the report 26% of high-tech firms and 29% of manufacturing firms are cloud-native leaders, compared with 11% of banking providers, 18% of insurers and 22% of CPRD (consumer products, retail and distribution) firms.

The survey highlights that priorities are changing as a result of the digital challengers, where banks now build 10% of their new applications using a cloud-native approach, while 47% of insurers and 27% of CPRD firms state that cloud native forms a core part of their technology strategies. 41% of banks, 44% of insurers and 41% of CPRD firm plan to spend considerably more on PaaS in three years than they do today.

What is recommended

The report states that Cloud native presents an opportunity for CIOs to change attitudes and demonstrate the innovation that IT can give to the business. It cautions that the benefits of microservices and DevOps, for example, will not be fully understood by CEOs or CMOs or line-of-business managers.

Companies making the shift to cloud native may even face the novel situation of the business having to catch up with IT. Hence, the report recommends that CIOs should argue that to make the connection a reality, the business lines must be ready to capitalize on the speed and flexibility cloud native gives them.

The report also offers six recommendations to help CIOs turn their organizations into cloud-native leaders:

- Assess the application portfolio and identify priorities for cloud-native development

- Build credibility by demonstrating a cloud roadmap and ability to deliver growth

- Start small, and then scale up to develop a skilled team

- Adapt the IT operating model to support both business agility and stability

- Be pragmatic in selecting technologies

- Incubate a culture of innovation, collaboration, testing and learning