The report titled, ‘Deploying Mobile Apps That Matter: 2015 Enterprise Mobile App Trend Report’ benchmarks enterprise mobility trends, analyzing app data from Apperian’s data warehouse of nearly two million mobile app installations since 2011.

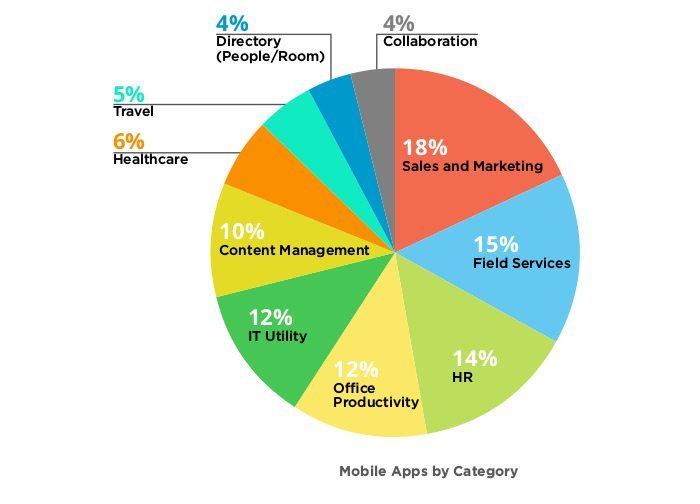

Close on the heels of ‘sales and marketing’ are ‘field service’ apps at 15 percent; followed by HR (14%), ‘office productivity’ (12%), ‘IT utility’ (12%) and ‘content management at 10 percent. Other minor shareholders include healthcare, travel, directory and collaboration at 6%, 5%, 4% and 4% respectively.

In a separate survey of 1,200 people, Apperian found that 71 percent of workers are accessing company information on mobile for at least two hours a week, with 36.5 percent accessing it for more than five hours. While nearly half of respondents said mobile apps would help them get work done better; for 41 percent of workers, organizations do not provide them with apps.

“Our research revealed some unexpected, yet actionable insights,” said Mark Lorion, Chief Marketing Officer at Apperian.

“While there are examples of successful apps deployed across entire enterprises, we’ve seen some remarkably innovative apps that are fundamentally changing how business is done – even when only one or two apps are deployed to smaller organizations or single teams. We’ve captured key enterprise mobility trends and are excited to share best practices gleaned from our research.”

Sales and Marketing

These apps, according to the report, universally tie into back-end systems, such as CRM systems, product catalogs, and inventory systems, and often lead to real-time quote generation. Other top-ranked apps in this category include salesperson training tools, pricing tools, competitor research tools, deal approval apps, and sales management apps. These apps are being deployed to full-time workers as well as to contracted salespeople, dealers, franchisees, and sales consultants.

Field Services Apps

They include apps being developed and deployed to assist field workers in part number-lookup and machine configuration, technician dispatch, work order processing, incident reporting, safety training and checklists, and field project planning. These apps tie into critical back-end systems such as ERP systems and other service and product systems.

Human Resources Apps

The category has a broad range of apps being developed to improve productivity and enable mobile access to frequently used corporate systems. Some apps offer corporate benefits information, such as healthcare coverage information, new employee orientation materials, and employee handbooks. Vacation planning and tracking as well as worker scheduling to help managers better plan for staffing too figure in the category. Interestingly, several of the most popular apps in this category assist workers in ordering catering from their corporate cafeteria and local caterers!

Office Productivity Apps

Here we see apps for expense reporting, project management, document creation and editing, business intelligence (BI) reporting, meeting tools, and survey/suggestion apps.

IT Utility Apps

These apps are broadly deployed by IT organizations to help users leverage IT services, such as VPN apps, user authentication, IT help desks, and IT policies.

Content Management Apps

Content management apps are deployed across many industries. These apps support easy access to professional journals, content libraries, corporate portals, company news feeds, and corporate communications.

Travel Apps

Travel apps help employees book and manage travel by integrating with the organization’s travel system. We also see travel and expense management apps as well as some customized apps to help workers coordinate with corporate campus shuttles or local transportation providers.

Collaboration Apps

This category encompasses apps such as enterprise instant messaging, private SMS, enterprise social collaboration, team messaging, and secure video collaboration.

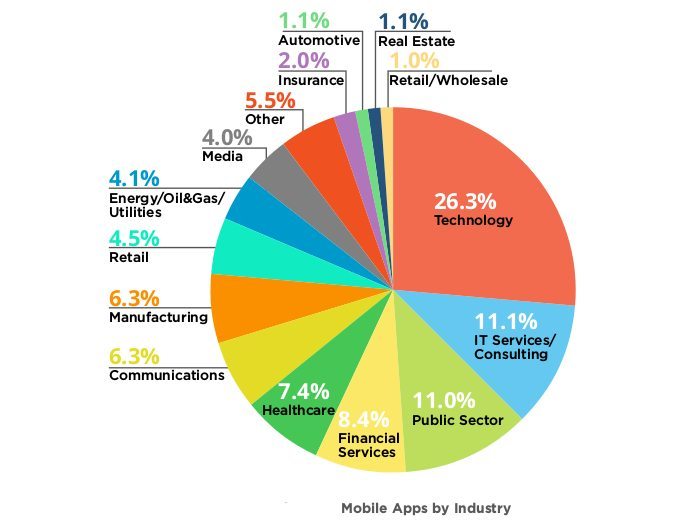

The adopters

Technology companies and IT services and consulting together comprise about a third of total apps deployed. These industries are heavy users of mobile apps and they traditionally have a large proportion of mobile and field-based workers.

Technology companies that develop and sell technology products such as semiconductor chips, lead the pack in app deployments. Their leadership in mobility is not surprising since tech companies hire tech-savvy workers who expect to leverage technology in support of their jobs.

Other industries leading the charge are Public Sector (11.0%) and Financial Services (8.4%), Healthcare (7.4%), and Communications (6.3%).

How much is too much?

The mean number of apps companies have deployed is up to nearly 35, while the median number is 13. The difference in these numbers indicates some companies have very large app portfolios.

iOS is America’s favourite

Across all worldwide production deployments, iOS is the dominant operating system, with 73.1% of all apps running on that platform. Android accounts for 26.5%; only 0.3% of all

apps currently run on Windows. The distributions shifts for data by region, with iOS being more popular in North America and Android in Europe and Asia. While Windows data is still relatively small, the number is expected to increase in 2016.

The entire report can be accessed here