Increasing usage of enterprise cloud apps; Okta - Business@Work

Okta, the cloud identity and mobility management company, recently released its second Business @ Work report, that identifies and understands how organizations and the people who work for and with them get work done. The report furnishes the apps, devices, and services that have been consumed daily by businesses, employees, partners, consumers and contractors in the past year. The report found out that traditional software companies are transforming themselves in the cloud, enterprises spreading their portfolio with new and emerging applications as well as certain companies are trying to challenge email.

Cloud Giants

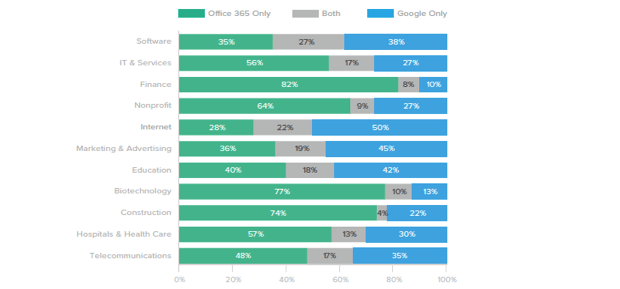

For example, most think that enterprises always lean towards a single parent cloud software solution; for example, companies either use Microsoft 365 or Google Apps to go about their business. Okta’s survey data states that over 40 per cent of companies using both Google Apps and Office 365 do so because different departments prefer different applications for online collaboration. Industries such as finance, biotech or construction are heavy users of Office 365, while Internet and marketing use Google Apps. The 30 per cent of overlapping customers who use both, use Office 365 for Word, Excel, and PowerPoint and it is the easiest way to license Office and keep it updated is via Office 365. The same group uses Google Apps for day-to-day email and collaboration.

Cutting e-mail some Slack?

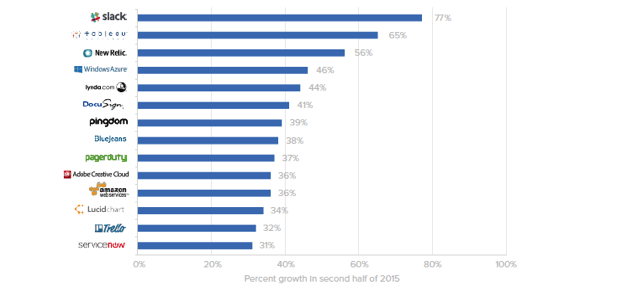

The report states that Microsoft Office 365 is the leader when it comes to application popularity, followed by followed by Salesforce, Box and Google Apps. What is interesting to see is the emergence of Slack in 2015 and its tremendous growth as one of the most deployed applications. Can it replace the email? Though Slack is doing well, with a 77 percent increase in adoption last year Stewart Butterfield, CEO Slack claims that the whole spectrum of communication within a company can happen inside Slack. Having said that, email remains the most widely assigned app today.

Rise of Cloud Apps

Thought the email has been the pathway to the cloud for many enterprises, with the advent of the ‘digital revolution’ employees are resorting to cloud applications to address a wider range of specialized roles for their companies. Developers, creative professionals, engineers and Human Resource teams are using niche cloud apps to meet their distinct needs making work more productive. Okta report states that not only are companies using off-the-shelf ‘public cloud’ services, as mainstream adoption of the cloud continues, custom apps that fill even more specialized needs are growing.

In Okta’s 2015 report, it found that the size of a company does not play a role in the number of off-the-shelf cloud apps employees can access. The current report shows an increase of 20 per cent as the numbers are pegged at 10 and 16 apps per company. But which are the cloud apps being adopted, we know Slack is one, interestingly platform apps such as New Relic at 56 per cent and Windows Azure at 46 per cent, were also among the fastest growing median off-the-shelf apps that were adopted in 2015.

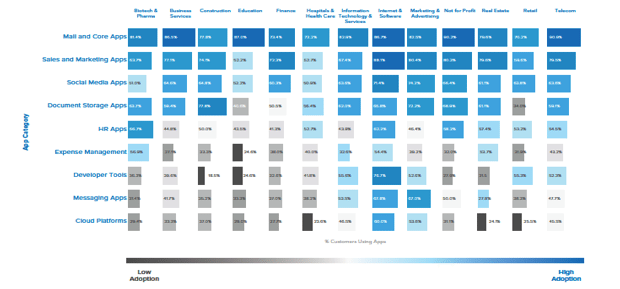

Where do Industry categories and Old School vendors stand in Cloud app adoption?

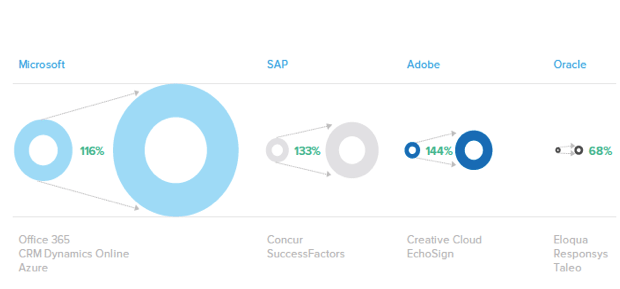

Unfortunately, when it comes to the deployment of cloud application companies in the finance, healthcare, and education are lagging behind. The software and the internet services sector have taken the lead in cloud app adoption. Having said that, traditional on-premise software like Microsoft, Adobe, SAP and Oracle have been making huge efforts to reinvent themselves in the cloud and the popularity of cloud apps has not been lost on these traditional software leaders.

In his first letter to employees as CEO, Satya Nadella wrote, “Our job is to ensure Microsoft will thrive in a mobile and cloud-first world.”

According to the survey Okta held, in the past year, cloud app adoption of Microsoft’s Office 365 grew 116 per cent. Adobe Creative Cloud grew 144 per cent. Several enterprises are either developing internally or are taking a more acquisitive approach to becoming cloud-first. For example, software giants like Oracle and SAP have successfully acquired major could companies. Under new management, cloud apps are helping keep these businesses relevant. SAP’s Concur and SuccessFactors adoption alone grew 131 per cent in 2015, Oracle adoption, with the help of Eloqua, Responsys and Taleo acquisitions, grew 68 percent.

Who is using what?

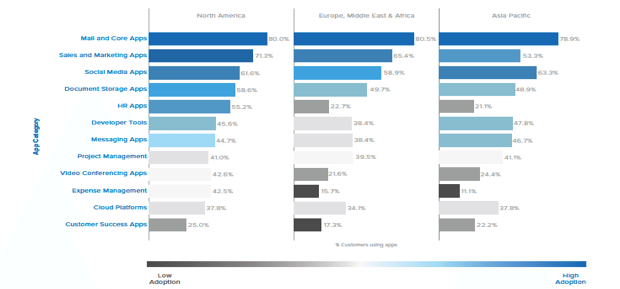

Across North America, Europe Middle-East and Africa, and Asia Pacific, apps such as mail, sales and marketing, and social media are well-represented. Document storage on an average has above 50 per cent penetration across these three geographies. HR applications have a 55 per cent penetration in North America but less than 23 per cent in both EMEA and Asia Pacific. Other lagging categories outside North America include video conferencing and expense management.

Okta report claims that app surge or lag depends on a number of factors such as varying economies, cultural differences, varying regulatory environments, market maturity, and vendor expansion strategies play a major role in adoption dynamics.

Okta report claims that app surge or lag depends on a number of factors such as varying economies, cultural differences, varying regulatory environments, market maturity, and vendor expansion strategies play a major role in adoption dynamics.

Broadly divided into 4 categories of user assignment to applications within an enterprise; apps such as Amazon Web Services, DocuSign, Google Analytics, Azure, Dropbox, Go To Meeting and New Relic have a 0 to 25 per cent average assignment rate. The 25 to 50 per cent category includes apps like Jira, Salesforce, Zendesk, and Cisco Webex. The 50 to 75 per cent has HipChat, Workday, Box and ServiceNow. The top 75 to 100 per cent have apps like Slack (that is still growing), Concur, Ultipro, Microsoft Office 365 and Google Apps. Interesting to see that apps above 50 per cent are all utility players.

Digital future

Okta report cites International Data Group that claims 76 per cent of IT decision makers say digital business initiatives to serve customers and partners are ‘very important’ or ‘critical’ in the next this year and the industry has just scratched the surface. According to a McKinsey Global Institute report, U.S. is operating at just 18 per cent of its digital potential, with cent per cent the market size would be worth $2 trillion.

According to Harvard Business Review, “ just about every individual, company and sector of the economy now has access to digital technologies—there are hardly any ‘have nots’ anymore.”

Businesses know that a good web and mobile experience increases business agility and productivity, and they are moving on it. Therefore, should enterprises build platforms or buy them? According to Okta, enterprises should do both as 80 per cent of enterprises are building custom applications on their platforms. One off-the-shelf cloud app; either Box, Jive or Salesforce is being used by 83 per cent of customers and partners today.